Huw Jones, Andrew MacAskill

LONDON (Reuters) - The British government and senior finance executives said they are increasingly confident Europe will offer financial companies generous market access after Brexit, boosting London’s hopes of retaining its status as a top global financial centre.

FILE PHOTO: A view of the London skyline shows the City of London financial district, seen from St Paul's Cathedral in London, Britain February 25, 2017. REUTERS/Neil Hall//File Photo

Since Britain voted to leave the EU 22 months ago, some of the world’s most powerful finance companies in London have been searching for a way to preserve the existing cross-border flow of trading after it leaves the bloc in March 2019.

“The fog is clearing ... We are already seeing progress,” the City minister John Glen told the CityWeek conference in the Square Mile’s Guildhall. “The EU have now recognised that there will be some form of market access in financial services, having previously dismissed the idea.

RELATED COVERAGE

Britain sticks to plans on EU customs union, government 'as one'

Britain sticks to plans on EU customs union, government 'as one'

Last month, EU states and the European Parliament formally recognised the need to discuss market access terms for financial services, having previously indicated they wouldn’t agree to a deal that would allow finance companies to operate in each others’ markets without barriers.

Britain’s vast financial services looks set to be one of the most divisive areas in the Brexit negotiations, with Britain demanding a generous deal while the EU refuses to shift from its insistence that Britain’s red lines — such as ending the free movement of workers from the EU — make that impossible.

Britain has proposed a future trade deal with the bloc for financial services based on mutual recognition of each other’s regulation. This model would be maintained by close co-operation between regulators and financial policymakers.

While EU policymakers have so far rejected the idea, saying it has never been done before on such a scale, leading figures in Britain’s financial sector reinforced their backing on Monday for the plan.

Mark Hoban, a former City minister and head of the think tank that authored the mutual recognition blueprint, said attitudes in the EU towards a financial services deal are shifting from “punishment to pragmatism”.

“Some of the views from member states who are more economically liberal, more outward looking, who regret most our departure, are much more pragmatic about out future relationship. The sands are shifting over time,” Hoban said.

Catherine McGuinness, policy chief for the City of London, home to the Square Mile financial district, said mutual recognition was the “only game in town”.

The alternative is a one-sided system whereby the bloc grants market access if a foreign country’s rules are fully aligned or “equivalent” with its own. Such access can also be terminated by Brussels at short notice.

Last month’s agreement by EU leaders spoke about “improved” equivalence, without elaborating.

Jean-Pierre Mustier, chief executive of Italian bank UniCredit Group which has operations in London, said there is a need to ensure that cross-border financial contracts and flow of data are not disrupted by Brexit, and that there is mutual recognition of rules.

“I have no doubt that the end of this public negotiation, we will find a solution... We intend to keep our team here,” Mustier said.

But Lorenzo Bini Smaghi, chairman of French bank SocGen, said that while he was also optimistic there will be agreement in financial services, he does not expect it to be as ambitious as the mutual recognition plan proposed by the City.

Norman Blackwell, chairman of Lloyds Banking Group (LLOY.L), said even if Britain fails to gain a deal it will remain one of the most important financial centres.

“European trade in financial services to the City is obviously important... but it is not life and death,” Blackwell said.

Nevertheless, banks, insurers and asset managers are already moving staff to new hubs in the EU to be sure of maintaining links with customers there, regardless of what is agreed in trading terms.

Some EU policymakers fear that Britain will ease rules for banks in a bid to keep London as a dominant global financial centre after Britain leaves the EU next March.

Glen dismissed talk of a “race to the bottom”, a move that would make it much harder for Britain to secure access to the EU’s financial market.

“We do not intend to rip up the rulebook after Brexit,” he said.

Reporting by Huw Jones and Andrew MacAskill, editing by Elizabeth Piper, William Maclean

We are Sunchine Inspection, your best choice of QC partner in China!

Monday, April 30, 2018

Sunday, April 29, 2018

Hainan to offer visa-free access to tourists from 59 countries

Source: Xinhua| 2018-04-18 11:12:18|Editor: Lifang

BEIJING, April 18 (Xinhua) -- China will offer a greater visa-free access to tourists from 59 countries arriving in Hainan Province from May 1, in a move to support the island's reform and opening-up, the State Immigration Administration announced Wednesday.

The visa-free policy will benefit group or individual tourists via travel agencies from 59 countries, including Russia, Britain, France, Germany, and the United States.

BEIJING, April 18 (Xinhua) -- China will offer a greater visa-free access to tourists from 59 countries arriving in Hainan Province from May 1, in a move to support the island's reform and opening-up, the State Immigration Administration announced Wednesday.

The visa-free policy will benefit group or individual tourists via travel agencies from 59 countries, including Russia, Britain, France, Germany, and the United States.

Saturday, April 28, 2018

WTO chief urges strengthening global cooperation to ease trade tensions

Source: Xinhua| 2018-04-22 02:39:48|Editor: Chengcheng

WASHINGTON, April 21 (Xinhua) -- World Trade Organization (WTO) Director-General Roberto Azevedo on Saturday urged global financial policymakers to strengthen cooperation through the WTO to ease trade tensions among major economies.

"Global cooperation will be essential in easing these tensions and safeguarding the strong growth that we are seeing today," Azevedo said in a statement to a meeting of the International Monetary Fund (IMF)'s policy setting committee.

"The WTO, which was created as a forum for members to hold each other to account, will play its proper role in this process," Azevedo said at the semi-annual International Monetary and Financial Committee (IMFC) meeting.

"It can be argued that without the WTO, a wave of protectionist measures would have been stirred up by the 2008 crisis, significantly worsening the economic effects of that downturn," he said.

The WTO chief warned that "a breakdown" in trade relations among major economies could "derail the recovery that we have seen in recent years."

"In an interconnected economy, the effects would likely be globalised, reaching far beyond those countries who are directly involved. In this scenario poor countries would stand to lose the most," he argued.

"I urge ministers to continue strengthening cooperation on global trade issues through the WTO. This will be essential to prevent current tensions from escalating, and to support growth, development and job creation around the world," Azevedo said.

The IMFC meeting was a part of the ongoing spring meetings of the IMF and World Bank in Washington. It comes after the Trump administration recently announced additional tariffs on imported steel and aluminum and threatened to impose broad tariffs against Chinese imports.

These unilateral protectionist measures have sparked widespread criticism and provoked threats of retaliation from major trading partners, raising the prospect of escalating global trade conflicts that threaten the global recovery.

WASHINGTON, April 21 (Xinhua) -- World Trade Organization (WTO) Director-General Roberto Azevedo on Saturday urged global financial policymakers to strengthen cooperation through the WTO to ease trade tensions among major economies.

"Global cooperation will be essential in easing these tensions and safeguarding the strong growth that we are seeing today," Azevedo said in a statement to a meeting of the International Monetary Fund (IMF)'s policy setting committee.

"The WTO, which was created as a forum for members to hold each other to account, will play its proper role in this process," Azevedo said at the semi-annual International Monetary and Financial Committee (IMFC) meeting.

"It can be argued that without the WTO, a wave of protectionist measures would have been stirred up by the 2008 crisis, significantly worsening the economic effects of that downturn," he said.

The WTO chief warned that "a breakdown" in trade relations among major economies could "derail the recovery that we have seen in recent years."

"In an interconnected economy, the effects would likely be globalised, reaching far beyond those countries who are directly involved. In this scenario poor countries would stand to lose the most," he argued.

"I urge ministers to continue strengthening cooperation on global trade issues through the WTO. This will be essential to prevent current tensions from escalating, and to support growth, development and job creation around the world," Azevedo said.

The IMFC meeting was a part of the ongoing spring meetings of the IMF and World Bank in Washington. It comes after the Trump administration recently announced additional tariffs on imported steel and aluminum and threatened to impose broad tariffs against Chinese imports.

These unilateral protectionist measures have sparked widespread criticism and provoked threats of retaliation from major trading partners, raising the prospect of escalating global trade conflicts that threaten the global recovery.

Friday, April 27, 2018

Finland's basic income trial falls flat

By Laurence Peter

BBC News

BBC News

The Finnish government has decided not to expand a limited trial in paying people a basic income, which has drawn much international interest.

Currently 2,000 unemployed Finns are receiving a flat monthly payment of €560 (£490; $685) as basic income.

"The eagerness of the government is evaporating. They rejected extra funding [for it]," said Olli Kangas, one of the experiment's designers.

Some see basic income as a way to get unemployed people into temporary jobs.

The argument is that, if paid universally, basic income would provide a guaranteed safety net. That would help to address insecurities associated with the "gig" economy, where workers do not have staff contracts.

Supporters say basic income would boost mobility in the labour market as people would still have an income between jobs.

Finland's two-year pilot scheme started in January 2017, making it the first European country to test an unconditional basic income. The 2,000 participants - all unemployed - were chosen randomly.

But it will not be extended after this year, as the government is now examining other schemes for reforming the Finnish social security system.

"I'm a little disappointed that the government decided not to expand it," said Prof Kangas, a researcher at the Social Insurance Institution (Kela), a Finnish government agency.

Speaking to the BBC from Turku, he said the government had turned down Kela's request for €40-70m extra to fund basic income for a group of employed Finns, instead of limiting the experiment to 2,000 unemployed people.

Another Kela researcher, Miska Simanainen, said "reforming the social security system is on the political agenda, but the politicians are also discussing many other models of social security, rather than just basic income".

When Finland launched the experiment its unemployment rate was 9.2% - higher than among its Nordic neighbours.

That, and the complexity of the Finnish social benefits system, fuelled the calls for ambitious social security reforms, including the basic income pilot.

The pilot's full results will not be released until late 2019.

OECD finds drawbacks

In February this year the influential OECD think tank said a universal credit system, like that being introduced in the UK, would work better than a basic income in Finland. Universal credit replaces several benefit payments with a single monthly sum.

The study by the Organisation for Economic Co-operation and Development said income tax would have to increase by nearly 30% to fund a basic income. It also argued that basic income would increase income inequality and raise Finland's poverty rate from 11.4% to 14.1%.

In contrast, the OECD said, universal credit would cut the poverty rate to 9.7%, as well as reduce complexity in the benefits system.

Another reform option being considered by Finnish politicians is a negative income tax, Prof Kangas said.

- Do welfare states boost economic growth, or stunt it?

Under that scheme, people whose income fell below a certain threshold would be exempt from income tax and would actually receive payments from the tax office.

The challenge is to find a cost-effective system that incentivises people to work, but that does not add to income inequality, Tuulia Hakola-Uusitalo of the Finnish Finance Ministry told the BBC.

What do others say about basic income?

Some powerful billionaire entrepreneurs are keen on the idea of universal basic income, recognising that job insecurity is inescapable in an age of increasing automation.

Among them are Tesla and Space X CEO Elon Musk, Facebook's Mark Zuckerberg and Virgin Group boss Richard Branson.

US venture capitalist Sam Altman, who runs start-up funder Y Combinator, is organising a basic income experiment.

Y Combinator will select 3,000 individuals in two US states and randomly assign 1,000 of them to receive $1,000 per month for three to five years. Their use of the unconditional payments will be closely monitored, and their spending compared with those who do not get the basic income.

In 2016, Swiss voters overwhelmingly rejected a proposal to introduce a guaranteed basic income for all.

Supporters of the proposal had suggested a monthly income of 2,500 Swiss francs (£1,834; $2,558) for adults and also 625 Swiss francs for each child.

FROM BBC News

Thursday, April 26, 2018

Dubai GDP up 2.63 pct in 2017 driven by transport, retail

Source: Xinhua| 2018-04-21 19:38:22|Editor: ZX

DUBAI, April 21 (Xinhua) -- The Dubai Statistics Center (DSC) said Saturday in a statement that Dubai's gross domestic product (GDP) reached 389 billion dirham (105 billion U.S. dollars) in 2017, up 2.63 percent year on year.

According to DSC, the transportation and storage sector contributed 18.5 percent to the total economic growth, surpassing the wholesale and retail trade, traditionally the largest sector in the emirate.

Arif Al Mehairi, Executive Director of the DSC, said wholesale and retail trade in 2017, worth 103.6 billion dirham, took up 26.6 percent of Dubai's real GDP and grew at a rate of 0.9 percent.

He said that the real estate sector accounted for 7.1 percent of Dubai's real GDP.

Prices for real estate have come under pressure in recent years due to an oversupply of new units, especially in the upper price segment, according to Jesse Downs, managing director of Phidar Advisory. For 2018, she does not expect a turnaround in prices due to "weaker demand."

The economic growth rate in Dubai slowed slightly in 2017, after the business metropolis of the United Arab Emirates (UAE) gained a 2.9-percent year-on-year growth in 2016, Dubai daily The Gulf Today reported citing the released Dubai Economic Report.

In order to stimulate the emirate which has a total population of approximately 2.5 million people, Dubai's ruler Sheikh Mohammed Bin Rashid Al Maktoum, also the Prime Minister and Vice President of the UAE, launched earlier last week a number of initiatives aimed at further boosting economic growth, UAE state news agency WAM reported.

The areas the Dubai government targets with these initiatives are "ease of doing business, cost of doing business, attractive investment-friendly environment, competitiveness, and sustainability," the report cited the ruler of Dubai.

DUBAI, April 21 (Xinhua) -- The Dubai Statistics Center (DSC) said Saturday in a statement that Dubai's gross domestic product (GDP) reached 389 billion dirham (105 billion U.S. dollars) in 2017, up 2.63 percent year on year.

According to DSC, the transportation and storage sector contributed 18.5 percent to the total economic growth, surpassing the wholesale and retail trade, traditionally the largest sector in the emirate.

Arif Al Mehairi, Executive Director of the DSC, said wholesale and retail trade in 2017, worth 103.6 billion dirham, took up 26.6 percent of Dubai's real GDP and grew at a rate of 0.9 percent.

He said that the real estate sector accounted for 7.1 percent of Dubai's real GDP.

Prices for real estate have come under pressure in recent years due to an oversupply of new units, especially in the upper price segment, according to Jesse Downs, managing director of Phidar Advisory. For 2018, she does not expect a turnaround in prices due to "weaker demand."

The economic growth rate in Dubai slowed slightly in 2017, after the business metropolis of the United Arab Emirates (UAE) gained a 2.9-percent year-on-year growth in 2016, Dubai daily The Gulf Today reported citing the released Dubai Economic Report.

In order to stimulate the emirate which has a total population of approximately 2.5 million people, Dubai's ruler Sheikh Mohammed Bin Rashid Al Maktoum, also the Prime Minister and Vice President of the UAE, launched earlier last week a number of initiatives aimed at further boosting economic growth, UAE state news agency WAM reported.

The areas the Dubai government targets with these initiatives are "ease of doing business, cost of doing business, attractive investment-friendly environment, competitiveness, and sustainability," the report cited the ruler of Dubai.

Wednesday, April 25, 2018

China-Ireland trade up 16 pct in first two months

Source: Xinhua 2018-04-20 06:18:05

DUBLIN, April 19 (Xinhua) -- The total value of the goods trade between China and Ireland reached 2.09 billion U.S. dollars in the first two months of this year, up 16.3 percent year on year from a year earlier, according to data released by the Chinese embassy in Ireland on Thursday.

An official with the economic and commercial section of the embassy quoted latest Chinese customs statistics as saying that during the January-February period of this year China imported 1.58 billion U.S. dollars of goods from Ireland while exporting to the latter 510 million U.S. dollars of goods, up 9.43 percent and 44.47 percent respectively over a year ago.

China's trade deficit with Ireland stood at 1.07 billion U.S. dollars in the first two months of this year, down 1.92 percent compared with the same period last year, said the official who declined to be named.

Currently China is the largest trade partner of Ireland in Asia. Last year China's trade with Ireland powered through the 10-billion-U.S.-dollar level for the first time in history.

According to the statistics recently released by the Irish government, China is the world's second largest market both for the Irish dairy products and pork.

Earlier this week, the Irish agriculture minister announced that Ireland has obtained the market access of its beef exports to China, making it one of the first European Union countries to get the market access to China since China banned the beef imports from the EU in 2001 due to a breakout of mad cow disease in Europe.

The lift of the Chinese ban on the Irish beef exports will surely serve a boost to the growing bilateral trade between the two countries, said an official with Bord Bia (Irish Food Board), a government body which is tasked to market the Irish agricultural food products overseas.

Editor: Mu Xuequan

DUBLIN, April 19 (Xinhua) -- The total value of the goods trade between China and Ireland reached 2.09 billion U.S. dollars in the first two months of this year, up 16.3 percent year on year from a year earlier, according to data released by the Chinese embassy in Ireland on Thursday.

An official with the economic and commercial section of the embassy quoted latest Chinese customs statistics as saying that during the January-February period of this year China imported 1.58 billion U.S. dollars of goods from Ireland while exporting to the latter 510 million U.S. dollars of goods, up 9.43 percent and 44.47 percent respectively over a year ago.

China's trade deficit with Ireland stood at 1.07 billion U.S. dollars in the first two months of this year, down 1.92 percent compared with the same period last year, said the official who declined to be named.

Currently China is the largest trade partner of Ireland in Asia. Last year China's trade with Ireland powered through the 10-billion-U.S.-dollar level for the first time in history.

According to the statistics recently released by the Irish government, China is the world's second largest market both for the Irish dairy products and pork.

Earlier this week, the Irish agriculture minister announced that Ireland has obtained the market access of its beef exports to China, making it one of the first European Union countries to get the market access to China since China banned the beef imports from the EU in 2001 due to a breakout of mad cow disease in Europe.

The lift of the Chinese ban on the Irish beef exports will surely serve a boost to the growing bilateral trade between the two countries, said an official with Bord Bia (Irish Food Board), a government body which is tasked to market the Irish agricultural food products overseas.

Editor: Mu Xuequan

China very important for global industrial production: Hanover Fair chairman

Source: Xinhua 2018-04-24 04:49:56

HANOVER, Germany, April 23 (Xinhua) -- China is very important for the global industrial production, according to the chairman of the Hanover Fair 2018, the world's leading industrial trade show, which runs from Monday to Friday.

"We are so happy to have such a great attendance from China. We have big brands like Huawei, Haier... After Germany, most exhibitors come from China. It is good for the show," Jochen Koeckler, chairman of Managing Board of Deutsche Messe responsible for the trade fair, said in an interview with Xinhua during the fair.

Koeckler said that some Chinese big brands, providing interesting technologies for the world, are very good and competitive.

"We are happy to see these competitions as organizer. Without competition, there is no innovation, no technical progress," he added.

Referring to trade tariffs, Koeckler told Xinhua that tariffs will in a short term protect their own economy, but in a long period make those countries less innovative.

"We are convinced that we do not need tariffs. We need a global exchange of goods that is very good for the global economic growth," he said.

According to Koeckler, the message of this year's fair is human-centric. There are many assistant systems, as well as many cooperative robots.

"The next level of industry 4.0 means that we have the real connection between the human being and the machines, so the factory will not be without human beings, but will be with a lot of workers, and the workers will be assisted by a lot of machines," Koeckler said.

More than 5,000 exhibitors from 75 different nations and regions are presenting technologies for tomorrow's factories and energy systems from April 23 to 27.

Some 60 percent of these exhibitors come from outside Germany. The top exhibiting nations after Germany are China, and Mexico, the official partner country of this year's fair.

Editor: yan

HANOVER, Germany, April 23 (Xinhua) -- China is very important for the global industrial production, according to the chairman of the Hanover Fair 2018, the world's leading industrial trade show, which runs from Monday to Friday.

"We are so happy to have such a great attendance from China. We have big brands like Huawei, Haier... After Germany, most exhibitors come from China. It is good for the show," Jochen Koeckler, chairman of Managing Board of Deutsche Messe responsible for the trade fair, said in an interview with Xinhua during the fair.

Koeckler said that some Chinese big brands, providing interesting technologies for the world, are very good and competitive.

"We are happy to see these competitions as organizer. Without competition, there is no innovation, no technical progress," he added.

Referring to trade tariffs, Koeckler told Xinhua that tariffs will in a short term protect their own economy, but in a long period make those countries less innovative.

"We are convinced that we do not need tariffs. We need a global exchange of goods that is very good for the global economic growth," he said.

According to Koeckler, the message of this year's fair is human-centric. There are many assistant systems, as well as many cooperative robots.

"The next level of industry 4.0 means that we have the real connection between the human being and the machines, so the factory will not be without human beings, but will be with a lot of workers, and the workers will be assisted by a lot of machines," Koeckler said.

More than 5,000 exhibitors from 75 different nations and regions are presenting technologies for tomorrow's factories and energy systems from April 23 to 27.

Some 60 percent of these exhibitors come from outside Germany. The top exhibiting nations after Germany are China, and Mexico, the official partner country of this year's fair.

Editor: yan

Tuesday, April 24, 2018

Britain, South Korea in talks to protect crude oil trade

Shadia Nasralla, Jane Chung

LONDON/SEOUL (Reuters) - Britain and South Korea are in talks to protect an arrangement of tax breaks for Korean buyers of North Sea crude beyond Britain’s upcoming exit from the EU, officials from both countries said, although a breakthrough does not look imminent.

Vessels that are used for towing oil rigs in the North Sea are moored up at William Wright docks in Hull, Britain November 2, 2017. REUTERS/Russell Boyce

An EU free-trade agreement has been in place since 2012 with South Korea, Asia’s fourth-largest economy and last year’s third-biggest importer of British North Sea crude, which is a significant source of revenue for the United Kingdom.

An EU free-trade agreement has been in place since 2012 with South Korea, Asia’s fourth-largest economy and last year’s third-biggest importer of British North Sea crude, which is a significant source of revenue for the United Kingdom.

Britain, which is trying to forge new trade relationships beyond Europe, will leave the EU next March and enjoy a status-quo transition until the end of 2020, according to the current plan.

The current trade deal allows EU exporters to sell their oil to South Korean refineries tax-free, and Britain has been the biggest beneficiary of this break.

A South Korean trade ministry official who has been part of the discussions, but declined to be named as he was not authorised to speak to media, said talks were going on between the two countries on a new trade deal.

“So far we have had two meetings after creating a so-called South Korea-UK trade working group. But as it’s not clear how details for the Brexit will be hashed out, at the moment, we have to wait and see.”

Talks between Britain and the European Union on their future trade relationship after Brexit started this week.

A spokesman for Britain’s Department for International Trade said the two sides hold regular discussions about how to retain the trade benefits, adding the “government will support (the oil) sector to maintain (its) reputation.”

The first meeting of the trade working group was held in Seoul in February 2017 and the second one was in London in December. The South Korean official said the date for their third meeting has not been set yet.

Last year, Korea imported 34.11 million barrels of British crude oil, up 83.5 percent from 2016, making up three percent of Korea’s total crude imports, according to data from state-run Korea National Oil Corp.

In the first two months of this year, South Korea imported 6.07 million barrels of British crude, down 1.67 per cent from a year ago.

Britain’s Department for International Trade said its oil exports to South Korea in 2017 earned Britain two billion pounds ($2.81 billion) and made up 14 percent of its total oil exports, the biggest share after the Netherlands and China.

In 2016, Britain exported oil to South Korea worth 800 million pounds, or eight percent of Britain’s total oil exports.

($1 = 0.7114 pounds)

Additional reporting by Amanda Cooper, Editing by William Maclean

Our Standards:The Thomson Reuters Trust Principles.

FROM: reuters

Czech signs memorandum of understanding with China's CITIC Group

Source: Xinhua 2018-04-20 04:22:45

PRAGUE, April 19 (Xinhua) -- Czech President Milos Zeman signed a memorandum of understanding on Thursday for a joint venture with China's state-owned investment company CITIC Group and CEFC Europe, the Czech-based branch of Chinese energy company CEFC.

As chancellor to the Czech president, Vratislav Mynar confirmed that the meeting between the president and a CITIC delegation took place on Wednesday.

According to the memorandum, CEFC Europe will hold a 51-percent stake in the venture, whereas CITIC Group is to hold the remaining 49 percent.

At the meeting, the parties discussed new investment projects as well as the strategy of CITIC Group to complete all current investments previously started by CEFC Europe in the Czech Republic.

The first involvement of CITIC Group in CEFC projects could begin within weeks. Mynar said the Chinese side showed serious interest in investing in the Czech Republic and plan to "invest a lot of energy and finance".

For instance, CITIC Group revived the agreement signed two years ago between China Development Bank and Czech J&T Holding Group about establishing a fund as a supporting platform for industrial and energy-related projects in the Czech Republic to the tune of about 800 million euros (988 million U.S. dollars).

"This is very interesting and it will be one of the priorities for the new projects," said Mynar.

Mynar said CITIC planned further meetings with other large Czech companies, such as J&T Holding Group, Zdas Zdar nad Sazavou metallurgy enterprise, Slavia football club, Lobkowicz brewery, and others.

Editor: Shi Yinglun

PRAGUE, April 19 (Xinhua) -- Czech President Milos Zeman signed a memorandum of understanding on Thursday for a joint venture with China's state-owned investment company CITIC Group and CEFC Europe, the Czech-based branch of Chinese energy company CEFC.

As chancellor to the Czech president, Vratislav Mynar confirmed that the meeting between the president and a CITIC delegation took place on Wednesday.

According to the memorandum, CEFC Europe will hold a 51-percent stake in the venture, whereas CITIC Group is to hold the remaining 49 percent.

At the meeting, the parties discussed new investment projects as well as the strategy of CITIC Group to complete all current investments previously started by CEFC Europe in the Czech Republic.

The first involvement of CITIC Group in CEFC projects could begin within weeks. Mynar said the Chinese side showed serious interest in investing in the Czech Republic and plan to "invest a lot of energy and finance".

For instance, CITIC Group revived the agreement signed two years ago between China Development Bank and Czech J&T Holding Group about establishing a fund as a supporting platform for industrial and energy-related projects in the Czech Republic to the tune of about 800 million euros (988 million U.S. dollars).

"This is very interesting and it will be one of the priorities for the new projects," said Mynar.

Mynar said CITIC planned further meetings with other large Czech companies, such as J&T Holding Group, Zdas Zdar nad Sazavou metallurgy enterprise, Slavia football club, Lobkowicz brewery, and others.

Editor: Shi Yinglun

Chinese yuan weakens to 6.3229 against USD Tuesday - Xinhua

Source: Xinhua| 2018-04-24 10:56:19|Editor: Liangyu

BEIJING, April 24 (Xinhua) -- The central parity rate of the Chinese currency renminbi, or the yuan, weakened substantially against the U.S. dollar on Tuesday tracking a strong greenback.

The yuan lost 195 basis points to 6.3229 against the U.S. dollar, according to the China Foreign Exchange Trade System.

In China's spot foreign exchange market, the yuan is allowed to rise or fall by 2 percent from the central parity rate each trading day.

Overnight, the U.S. dollar hit its strongest level since early March, with investors bidding up the currency ahead of a set of key economic events later this week.

The dollar index, a measure of the greenback against six developed market currencies, jumped to 91.035 on Monday.

The central parity rate of the yuan against the U.S. dollar is based on a weighted average of prices offered by market makers before the opening of the interbank market each business day.

China's Alibaba signs agreement with automakers to connect cars to homes - BBC News

Source: Xinhua| 2018-04-24 11:11:22|Editor: Liangyu

BEIJING, April 24 (Xinhua) -- Chinese e-commerce giant Alibaba has signed an agreement to supply its artificial intelligence technology to global automakers, assisting Mercedes-Benz, Audi, and Volvo car owners in China to control their cars from home.

The voice-activated assistant Tmall Genie, which was developed by Alibaba AI Labs, the company's artificial intelligence arm, will allow home-to-vehicle connectivity, Alibaba said Monday.

"Users will be able to turn on air conditioning, lock car doors, and open the trunk from their home," said Chen Lijuan, head of Alibaba AI Labs.

Tmall Genie could also perform functions like planning a route or controlling music.

The voice assistant will also allow car owners to perform diagnostics on the car's engine, battery, and other components and check the car's location and fuel levels in the future, according to Alibaba.

Chen said Tmall Genie uses voiceprint recognition technology to identify authorized car users.

China to commercialize 5G technology by second half of 2019 - Xinhua

Source: Xinhua| 2018-04-23 22:33:09|Editor: yan

FUZHOU, April 23 (Xinhua) -- China will apply 5G technology to terminal devices as early as the second half of 2019, leading to the primary commercialization of the technology in the near future, according to an official with the Ministry of Industry and Information Technology (MIIT).

"China started 5G research experiments in 2016, and entered the third stage of system verification this year," Wen Ku, head of the MIIT information and communication department, said at the ongoing first Digital China Summit in Fuzhou, capital of east China's Fujian Province.

China has launched 5G cooperation mechanisms with Japan, the Republic of Korea, the European Union and the United States, with international companies joining the research and development, he said.

Wen said device manufacturers such as Huawei and Ericsson had participated in development of 5G products to help create a complete 5G industrial chain.

Given the significantly greater speed -- up to 10 gigabits per second -- that 5G offers, the next-generation ultra-fast networks will see ways of life change more than in the 4G era, in virtually everything from how we "interact" with our cars to how we use the products in our homes.

Boeing invests in 3D printing startup for stronger engineering capabilities - Xinhua

Source: Xinhua 2018-04-24 03:54:41

SAN FRANCISCO, April 23 (Xinhua) -- U.S. aircraft giant Boeing Monday announced its investment in a California-based 3D printing startup to seek greater engineering capabilities for its aerospace development.

Boeing said its investment in Morf3D, to be delivered by its investment arm HorizonX, reaffirms its commitment to a competitive ecosystem for aerospace-quality 3D-printed parts. Boeing HorizonX Ventures co-led this Series A funding round, but it did not disclose the specific amount.

As a startup company established in 2015, Morf3D mainly focused on metal additive engineering and manufacturing, a technology that enables lighter and stronger 3D-printed parts for aerospace applications.

Morf3D has produced 3D-printed titanium and aluminum components for Boeing satellites and helicopters since its establishment more than 3 years ago.

Morf3D's metallurgy experts leverage a new set of additive manufacturing design rules to advance the technology and accelerate 3D-printing capabilities for commercial use, Boeing said.

Boeing recognized the company's ability to utilize state-of-the-art software combined with engineering expertise to significantly reduce mass, and increase the performance and functionality of manufactured parts.

"Developing standard additive manufacturing processes for aerospace components benefits both companies and empowers us to fully unleash the value of this transformative technology," said Kim Smith, vice president and general manager of Fabrication for Boeing Commercial Airplanes and Boeing Additive Manufacturing leader.

Apart from Morf3D, Boeing has previously partnered with Norway's Norsk Titanium and Swiss-based Oerlikon to produce structural titanium parts and additive materials for its commercial airplanes.

Editor: yan

UK government borrowing lowest for 11 years - BBC News

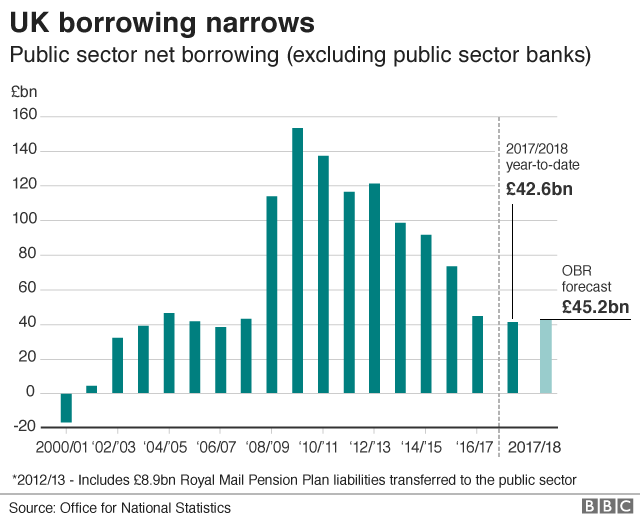

Government borrowing has fallen to its lowest annual level in 11 years, according to the latest official figures.

Borrowing fell by £3.5bn to £42.6bn in the 2017-18 financial year, the Office for National Statistics (ONS) said.

That was below the estimate of £45.2bn produced by the independent Office for Budget Responsibility last month.

Borrowing narrowed to 2.1% of gross domestic product (GDP) last year, down from 10% in 2010.

However, total public debt as a percentage of GDP edged up to 86.3%, up from 85.3% the year before. In cash terms it stands at £1.798 trillion.

The figures are the first provisional estimates of the last financial year. The ONS stressed they would be revised as more data becomes available.

March's deficit was £1.3bn, well below a forecast for a gap of £3.25bn.

The borrowing figure does not include the amount spent on supporting the state-owned banks.

Mr Hammond has kept the broad aim of the previous chancellor, George Osborne, of reducing the gap between spending and borrowing, although he has eased off on the pace of cut-backs.

Mr Hammond said: "Thanks to the hard work of the British people, borrowing is the lowest in over a decade. Our economy is at a turning point with debt starting to fall and people's wages rising, as we build an economy that truly works for everyone."

'Key challenge'

But Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the figures did not necessarily indicate an improving economy: "Rapidly falling public borrowing continues to reflect sharp falls in spending, rather than a reviving economy.

"Lower borrowing in March than last year primarily reflected a £1.0bn decline in interest payments and a £1.4bn reduction in Local Authority borrowing. Both these expenditure components are volatile and tell us little about the underlying health of the economy."

John Hawksworth, chief economist at PwC, said: "The key challenge facing the chancellor in his Budget in November will be how to trade-off growing political pressures to ease austerity against his desire to get the debt ratio down as far as possible.

"The undershoot in the deficit this year has given the chancellor a little more wriggle room, but it does not alter the fundamental strategic choice he will need to make in November."

From: BBC News

Monday, April 16, 2018

Google owner Alphabet sees profits soar

Profits at Google-owner Alphabet jumped almost 73% in the first three months of the year, as revenues from internet advertising soared.

The strong results came despite fears that rising costs and regulation could undermine the search giant's performance.

First-quarter net income rose to $9.4bn (£6.7bn) from $5.4bn a year earlier, beating analyst expectations.

Revenue jumped 26% to $31.1bn from $24.8bn.

During the quarter, the search giant enjoyed a $3bn boost from a change to accounting rules, as well as a $1.1bn uplift from currency exchange movements.

However, it attributed much of the growth to higher pricing for online ads on its Google search engine, YouTube video service and partner apps and websites.

Ivan Feinseth, an analyst at Tigress Financial Partners, said: "The strong economy has companies spending more on advertising and we have an ongoing migration from traditional types of media advertising to greater online and social media-based advertising."

Mounting pressure

Alphabet's profit margins have fallen in recent quarters as it reinvests in areas of its business such as cloud computing and hardware.

Alphabet's profit margins have fallen in recent quarters as it reinvests in areas of its business such as cloud computing and hardware.

And the firm admitted capital spending almost tripled to $7.7bn during the first quarter.

Its shares have also fluctuated in 2018 amid mounting pressure from regulators to change its business practices.

Investors are particularly worried about the European Union's new General Data Protection Regulation (GDPR), due to come in on 25 May, which will give the public more control over their data and ramp up fines for data breaches.

Some analysts believe it could prompt some users to reject receiving personalised ads online, hitting Google's sales.

However, in a conference call with reporters, Google boss Sundar Pichai played down the concerns.

"GDPR is a fairly new public topic, but for us it is not new - we started working on it 18 months ago.

"We are working very closely with our publishers and our partners… It is a big effort, we are very committed to it and to getting it right."

Alphabet shares jumped almost 1% in after-hours trading before slipping back.

From: BBC News

Friday, April 13, 2018

You should pay more attention to Quality Control, here’s why

By Elyssa

Sourcing in China can be daunting, especially when you don’t have years of experience doing it. When you manage to avoid the pitfalls of selecting the right supplier, it’s time to get real with Quality Control.

Quality Control (QC) is a process implemented to ensure that a manufactured product adheres to a set of quality criteria and meets the requirements of the client or customer. As it’s often overlooked and lacks defined processes in most companies, it might generate important additional costs to your sourcing process.

In order to give you a few pointers on how to improve Quality Control in your company, we’ve met with Renaud Anjoran, founder at SynControl, who has over 10 years’ experience in quality control and helps buying offices manage their inspectors’ work better.

You co-founded SynControl, a software company for managing QC inspections. How did you come up with it?

There is a lack of process in the QC operations of most buying offices. To give a few examples:

There is a lack of process in the QC operations of most buying offices. To give a few examples:

- Inspectors work outside a strict framework, which means one inspector might find issues that his colleague wouldn’t find. It is a serious reliability issue.

- Managers often get partial information (a few photos through Wechat) outside of context, and get the full report much later at night.

- Issues detected by inspectors or auditors are not followed up and used for driving improvements.

What is, according to you, the most challenging part of QC?

For the QC manager, it is keeping a control over what happens when his/her team is working in suppliers’ factories, far away from the office.

For the individual inspector, it is balancing the needs of proper processes and reporting with the flexibility required because of the constant urgencies of production.

What would you say would be a typical good process for QC?

A few elements of a good QC process would be:

- Documented checklists and defect lists

- The inspector’s workflow is structured by the checklist

- Findings are documented immediately without extra time/effort

- The final report is available and distributed to the right people once the inspection is over https://www.sunchineinspection.com/services/

How does your software help with designing better Quality Control processes?

- Inspectors follow the checklist on their mobile app

- Photos/videos can be taken as fast on a smartphone/tablet as they were previously with a digital camera

- Once all the findings are sync’ed up to the server, the final report is generated automatically and sent by email.

I understand you have a lot of QC field experience, what’s the funniest thing that ever happened to you?

An inspector can see a lot of things, and sometimes hear a lot of things. In 2007 I had a client who was an importer. They purchased from a Hong Kong-based trading company that had a team in China to follow production. The client came and set up the lines and the machines when production was starting (or so they thought). Once the client was gone, the factory simply subcontracted the work to another workshop. The Chinese staff in the trading company was aware of it but not their managers in Hong Kong. When we came for the final inspection it was obvious there was an issue – we were finding defects that could only come from machines not set up by the client’s engineer. The client figured it out and they were quite upset. I am under the impression that the Hong Kong managers are still scratching their heads over what happened…

What’s your favourite feature of SynControl, the one thing that makes you proud?

The ability for office people to see what the inspector has found at any point during the day. Obviously it implies that the inspector’s mobile app is connected to the internet but in China that’s not an issue in 90%+ of cases.

Finally, If you had to give one advice for QC to our readers, what would it be?

If you define processes that make sense to your company, and you hire a certain profile of inspectors who like to follow a sequence of steps in a systematic manner, you will tend to do well. If you leave things to chance and hope for the best, you might be terribly disappointed.

Thursday, April 12, 2018

Sourcing from China 101, Part 5: Negotiation: The Terms you Need to Discuss

Chinese suppliers are good at detecting which purchaser is inexperienced.

If that’s the case, and if you are dealing with dishonest suppliers, they could think that they will be able to take advantage of you.

Therefore, it is important that you come across as someone who is fully prepared. You need to know what to ask, and how to respond when a supplier is being unreasonable.

Let’s have a look at the main terms you will need to discuss with potential suppliers. I advise you to discuss most of these terms in your very first discussion/meeting with each potential supplier.

1. Total lead time (and shipment date)

From the very beginning, you need to ask them two things:

- What months are you most busy? And when are you less busy?

- Once a perfect sample is approved, and you get the green light for production, how many days do you need before you can ship the goods?

Note: you should always keep these two pieces of advice in mind when discussing lead times:

- Whatever they promise you, add 3-4 weeks to your internal planning if they are a new supplier. And 2 weeks should be fine if they are already an regular supplier.

- When you discuss timing, always remind them that quality needs to be maintained to the approved standard. If you ask them to rush production, you are giving them an excuse for poor quality!

2. Incoterms

Along with their quotation, they should write something like “FOB Shenzhen” (or FOB another port). This means they pay the costs until the port of Shenzhen; you are then responsible for the shipment and delivery of goods to your final destination. FOB is by far the most common incoterm.

The good news is, you are in control of the freight if you buy FOB, but you will need to find a freight forwarder — You can find out more about your 4 options this article.

If the supplier offers to take care of the international freight, you should only accept it if the incoterm is DDP [your warehouse] or at a minimum DDU [your warehouse]. It means they will take care of all the freight until your warehouse, door to door. NOTE: in DDU terms, import duties are unpaid, so you’ll need to work with a customs and excise broker.

Important note: in most cases you should NOT accept CIF terms. In most cases, the price will be interesting but there is a catch… You will probably have to pay extremely high “local” fees.

When it comes to airfreight, specific incoterms apply. Your freight forwarder should be able to explain the nuances to you.

3. Intellectual property rights (if your product is unique)

Importers are often afraid of a Chinese company reverse-engineering and copying their products. But most cases of IP infringement involve the original supplier/manufacturer!

It should be no surprise, since they are the ones that went through the hard work of product development and getting the product into manufacture, they also have a sense of their buyer’s business model.

If you do not want your supplier to turn into your competitor, you should take a few precautions.

First, be aware of common legal strategies. You should register your trademark in China before production starts. And you should have your supplier sign a NNN agreement. Let’s break it down a bit:

- Non-disclosure agreement — most people think about this one. But the way it is written (in particular the jurisdiction that is competent in case of a breach) often makes it unenforceable.

- Non-use — since disclosure may be very difficult to prove, you want to make it clear that your confidential information will not be used outside of the intended project.

- Non-circumvention — you might not be able to prove that the receiving party disclosed the information or that they used it (it might be done in another facility, under a distant cousin’s name). But you also want to make sure they don’t try to sell your product to your own customer(s).

Second, use non-legal strategies. If you are ready to pay a little more to reduce IP risks, you should structure your supply chain yourself and place a firewall between its major elements:

- Find and qualify the components suppliers (that’s not a must);

- Distribute the processing and pre-assembly across several factories;

- Give the final step (assembly & packing) to a manufacturer that does not know the other factories involved, or that is specialized in acting as a “black box”. There are a few of them in China.

4. Access to, and transparency about, the manufacturing site

Even if you have confirmed that you work directly with a manufacturer, your order might be subcontracted to a smaller workshop—either because they run out of capacity, or because they want to widen their profit margin. When this happens, you run higher chances of a quality disaster.

So, what can you do to prevent it?

- Make it very clear to your supplier that production is to take place in the approved factory only, unless they get your written authorization to do otherwise for a particular order. Get a written commitment about this, and place this term on your purchase orders.

- Have the supplier confirm that your representatives (be they your staff or a third party) can go in the factory and check your product at any time during production.

- Observe production if you can be on site, especially for the first run. You can also send in an inspector who will report on the location of production.

- Try to avoid your supplier’s peak season as well as the period around Chinese New Year.

5. Quality standard & product specifications, and certifications

In Chinese suppliers’ minds, quality is tightly linked to prices. If you ask for a low price, it is implied that you will be less strict on quality.

Therefore, one of the key elements while negotiating is: you can discuss prices, but you need to make it extra clear that your quality standard is not negotiable. Better still, you should define your quality standards precisely.

You also need to make sure the product you are buying is compliant to the regulations of the countries where you intend to sell it. Tell the supplier about those countries. If you buy an off-the-shelf product, do they already have the right certifications? Can you see them? If not, who will pay for them?

6. Payment terms

Accepting a slightly higher price in exchange for more favorable payment terms can be great business.

If you purchase products in a very competitive industry, and if you know that many suppliers will fight to get your business, you can try to negotiate the following terms: 30% before production / 50% just after shipment / 20% after delivery in your warehouse.

Similarly, if you plan to use letters of credit, you need to mention it the very first time you exchange with a potential supplier. If they refuse this payment mode, or if the amount of your orders is too low to justify a letter of credit, it is best to know about it right away.

The advantage of a letter of credit is that you don’t get “hooked” by a 30% down payment (which is never ever sent back by a supplier to a customer).

7. Other common terms

Some other common terms that are often included in OEM agreements are:

- Who pay for the first inspection and the first laboratory test, and who pays the following ones in case of a failure

- Penalties for late shipment, chargebacks for mistakes, etc.

- Control over price increases

- Compensation if the supplier cannot deliver

- Right to refuse orders

A lawyer can tell you more about all this. But I hope I presented an overall picture that will be useful to some importers.

Is there anything important that I missed?

Wednesday, April 11, 2018

Sourcing from China 101, Part 7: Pre-Production: Describing What You Want

I have stated several times that you need to describe your product in detail.

I know this is obvious, but most buyers don’t do is well… and often regret it later.

There are two ways of formalizing your requirements:

- A written specification sheet, which contains all your expectations regarding the product and its packaging.

- Pre-production samples, which are supposed to represent what cannot easily be described in written form: the look & feel, the quality of the finishing, etc.

1. The written specification sheet

Writing a spec sheet before production starts serves two purposes:

a) Communicating your requirements, on your terms.

Even if you purchase standard items (with no customization), you should not rely on the supplier’s catalogue information. Some important information might be missing; the tolerances might be too loose, and so on.

Keep in mind that, for every specification that is not defined, you put your trust in the supplier to make a good decision.

But who will make these decisions? People like purchasing officers and production technicians. In other words, people whose main objective it is to save money. For example, they will buy the cheapest cartons if you don’t specify the type of packaging you want.

Maybe you have no idea of what you really require. The easiest way is often to ask the supplier to show you what they do for other customers. If you want something different, ask the supplier to propose something else.

b) Providing a basis for quality control.

Let’s say you purchase pens. When you receive the shipment, you notice that the pens run out of ink after writing for a day. You complain to the manufacturer, who tells you “of course, if you write for 24 hours nonstop, it is possible to run out of ink”. You reply “no, I mean after writing for 1 hour”. This type of discussion can last for a long time.

Is this a silly example? No. It is representative of the situation of many buyers who have not taken the pain to write their requirements down in a way that forms the basis of a quality control checklist.

To get back to the pens, an example of product specification could be: the pens should “provide for at least 2 km of writing on standard paper sheets” and “the empty space inside the cartridge should be between 0.5cm and 1.5cm” (this would be just part of the specification).

Note 1: do not count on the supplier’s salesperson to take care of these details

Chinese factories often hire a few English-speaking young graduates to communicate with foreign customers. When you send your requirements, these salespeople will take care of the translation. But they are seldom good interpreters, because many of them have zero technical knowledge.

To avoid misunderstandings, here are a few tips:

- Use as many photos and drawings as possible, rather than text.

- If you have the resources for it, translate the specifications yourself.

- Even better, go in the factory and collect feedback/questions from technicians and managers. Don’t go through the sales rep’s filter. Ask a manager to stamp and sign on the document.

(Note: quality assurance agencies can generally help with translation and feedback collection. We do this from time to time, and it improves communication immensely.)

3. Defining potential defects

How to define your quality standard? Or, put another way, what should be considered a major defect?

Unfortunately, pre-production samples are not sufficient since they don’t show any defect. So, the definition of potential defects needs to be in the spec sheet.

It is virtually impossible to list 100% of possible defects. However, it is worth spending a little time defining the 20% of defects that come back 80% of the time.

Once you have a list of defects, you should decide on their severity, based on these three categories:

- Critical defects might harm a user, or do not respect the importing country’s regulations. Tolerance is generally 0.

- Major defects are usually not accepted by end consumers/users, so they would not buy the product. The corresponding AQL limit is generally 1.5% or 2.5%.

- Minor defects are the slight issues that usually don’t prevent the sale of the product. The corresponding AQL limit is generally 4.0%.

Using a template for the spec sheet

If you don’t know where to start, you are welcome to use the free template you will find here.

2. Pre-production samples (or “golden samples”)

Descriptions and photos only go so far. You should request a perfect pre-production sample (often called “golden sample”) before production starts.

Most of the time, the supplier needs to submit samples several times before the buyer accepts them.

When you receive development samples that are not satisfactory, take clear photos of the problems and insert them in the spec sheet. Use arrows to point at the problems, and show “OK” or “NOT OK”.

Once you approve a perfect sample, you need to make sure the factory has also kept at least one for their reference, and then make sure inspectors have at least one.

Identifying and protecting samples

As I wrote before, the touch & feel of the product is often difficult to describe. This is why pre-production samples are necessary.

Make sure to identify these samples in a way that cannot easily be altered. For example: ink stamping on a garment, or a seal attached to a hard good.

You would be surprised to see how fast samples can deteriorate in a factory. They go from hand to hand, they collect dust, they are sometimes cut (to verify internal workmanship), and so on. They should be kept in a bag, at the very least, and ideally quarantined away from production areas.

The best is to renew perfect samples every few months. Over time colors start to fade, buttons start to be less responsive, and so on. Don’t let an entire year go by.

Over-promise and under-deliver

Will mass production look like the “golden samples”? Of course not, but no Chinese supplier will tell you about this before you issue an order.

In China, fierce competition means that every supplier feels the need to over-promise, in order to acquire new customers. This is why you need to define your quality standard precisely and have it confirmed before production starts.

The very best way to communicate your quality standard before production starts

The best is to push the factory to do a pilot run on 50-100 pieces.

That’s how buyers with a very high quality standard are forced to operate – they can give feedback to the factory on the pilot run’s quality, and confirm a manufacturer’s ability (or inability) to reach their requirements.

However, very few factories in China accept to do a pilot run. If they really want your business and if they can buy the components in small quantity, this is something you can try to negotiate.

—

Another important topic is the way to follow the advancement of your orders (through development, production, and transportation). This is what we’ll cover in the next part of this series.

Tuesday, April 10, 2018

Sourcing from China 101, Part 6: Keep Some Leverage with Suppliers

Up until now, I have explained how to find a good supplier and what terms to negotiate from the get-go.

But this is not enough. Buyers who are new to China often make a mistake: they trust their suppliers too much.

China is a dog-eat-dog environment. You can’t trust a company simply because you have checked and qualified them. You need to structure your deals in such a way that you keep some power over your supplier.

I know three good ways of doing this.

1. Payment by bank wire: release payments after milestones are reached

Bank wire (or “T/T”, which stands for “telegraphic transfer”), is the main payment method in international trade.

It is usually done in two steps:

- A 30% down payment, before components are ordered. Chinese suppliers like to call it a “deposit”, but make no mistake: they never return it once they receive it.

- The balance of 70%, to be paid after production is completed. You should try to pay it after shipment, but many suppliers are reluctant to accept this – it means they get paid later than they would like, and they think this gives you the opportunity to “play games” (such as asking for a discount) after they have shipped the goods.

It is relatively cheap. In many cases it looks like this (image source: http://www.hsbc.com.my):

In case you cannot negotiate final payment after shipment, make sure it takes place after product has been inspected and confirmed everything meets your specifications.

Special case: if an investment in tooling or molds is necessary

You might have to pay for molds before you get perfect samples. It makes sense. But, if the value is high, you might want to talk to a lawyer (see section 3, at the bottom of this article).

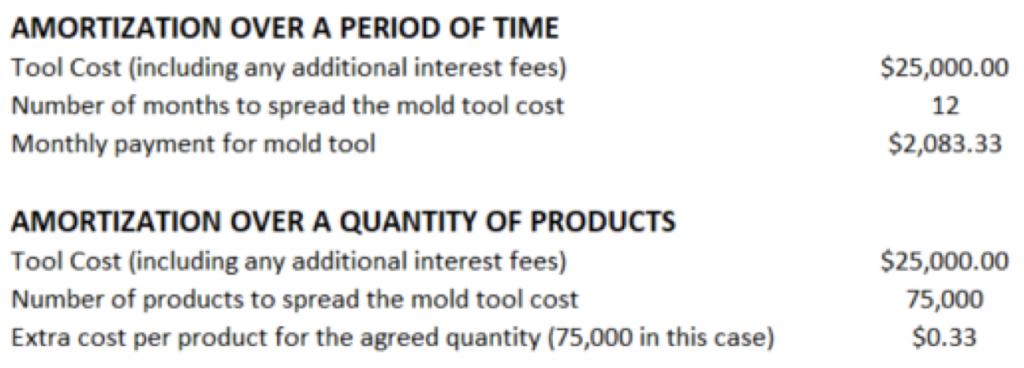

There is one option open to negotiate, that of amortization. This is normally a negotiating point where the mold tool capital cost is relatively high and the buyer negotiates with the supplier to spread the cost of the mold tool over, either a production period of time or a quantity of production items. An example of this is shown below:

The principle is that you should keep some leverage in your hands as long as possible. In practical terms, this means you owe some money to your supplier until shipment. This way, they will listen to your requests.

4 things you should NEVER do

- Never pre-pay 100% of the order before production starts. This is just dumb. I have seen buyers make this mistake and deeply regret it. Try it and you will understand why leverage is important!

- Never wire the down payment before having a high certainty that the factory knows exactly what you want. Many buyers issue a PO, then receive a perfect sample, and then send the down payment.

- Never wire money to a personal account.

- Never wire money to an account name that is different from your supplier name, without asking for a written explanation.

What you should try to negotiate for over time

As you become a regular customer, and if you feel the supplier is making a decent margin on your orders, you should ask for this payment structure: 30% down – 50% after shipment – 20% after delivery in your warehouse.

This is still relatively rare, but is slowly becoming more common.

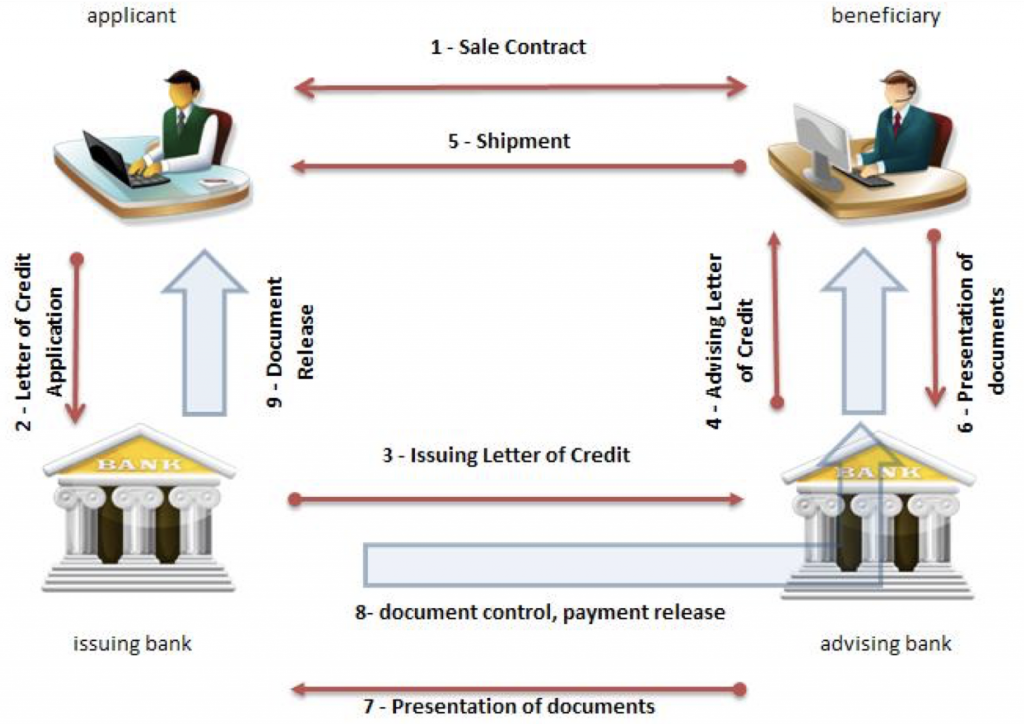

2. Payment by letter of credit: safer for the buyer, but not always an option

Payments by letter of credit (L/C) are more complex than T/T. But they offer some benefits to the buyer.

How an L/C protects the buyer

- No advance payment is necessary (since the buyer’s bank guarantees payment to the seller’s bank, at condition that certain documents be presented);

- One of these documents should be a “certificate of quality control by [your nominated inspection firm]”. If the QC inspection didn’t happen, or was not acceptable to the buyer, the supplier needs the buyer to “waive the discrepancies” before payment is released.

- There are virtually always discrepancies. It means that, in the end, the buyer calls the shots. He can decide to waive discrepancies a little late, to extend payment terms. He is in a position to negotiate a discount if the supplier has cut corners somewhere.

Downsides of L/Cs

- They are expensive. Banks charge much higher fees for L/Cs than for T/Ts. It means they are not a realistic solution for orders below 30,000 USD.

- Many suppliers do not accept L/Cs. Maybe they are short on cash (and they need advance payments), or maybe they had bad experiences in the past. But sometimes, reassuring a supplier is enough to have them accept an L/C.

A few tips to reassure suppliers

- Many buyers pay by L/C for their first order with a new supplier, and then switch to T/T. If that’s the case, make sure to mention it.

- Use an international and famous bank to open your L/Cs.

- Better yet, show a draft of your L/C to the supplier before you open it formally. If they don’t agree on a term that is of minor importance to you, just let it go.

3. Sign an enforceable contract, for extra leverage

Most importers are NOT aware of these two facts:

- Your purchase order is not considered a contract!

- A contract that calls for litigation in your country is certain useless with a Chinese supplier, unless their company has assets in your country.

If you want a contract (also called “OEM agreement”) that you can enforce in a Chinese court of law or in an arbitration body, it should be drafted by a lawyer who is familiar with China business. (I usually recommend Dan Harris and Steve Dickinson, from Harris Bricken).

Most of the terms are fairly standard, but they should be customized to your situation:

- The written description of the product will be attached in appendix;

- Subcontracting can be forbidden;

- Payment terms can be formalized;

- Ownership of special tooling or molds can be clarified;

- IP non-disclosure can be requested.

The major benefit of having a contract is the leverage it gives you in front of your supplier. Naturally you don’t want to sue them, but you can threaten them to do so!

Drafting a Chinese contract is not cheap, but it is usually a one-time fee. Once you have the template, you can probably re-use it for other orders if the supplier accepts the same terms. It should be structured so that only the exhibits (product specs, purchase order…) need to be changed from order to order.

—

I have mentioned several times the need to be very precise, and to specify what is required down to the finite details. The next article in this series, we’ll see how a buyer can describe his expectations when it comes to the product itself.

Subscribe to:

Comments (Atom)

China welcomes U.S. to visit China to discuss trade

BUSINESS NEWSAPRIL 22, 2018 / 1:14 PM / BEIJING (Reuters) - China on Sunday said it welcomed plans by top U.S. officials to visit the coun...

-

BY RENAUD ANJORAN This article introduces the different options available to buyers, when it comes to the representativity of inspection fi...

-

BY RENAUD ANJORAN This is the second part of the presentation I gave a group of Chinese suppliers. The first part, about the initial sourc...

-

(People's Daily Online) 13:52, January 10, 2018 China’s foreign trade is expected to exceed $4 trillion in 2017, and the foundation ...